If you’re just starting to get your own money, like from allowance, a part-time job, or birthday gifts, you might hear about checking and savings accounts. They sound similar, but they actually do different things. Here’s a simple way to understand the difference.

Checking Account

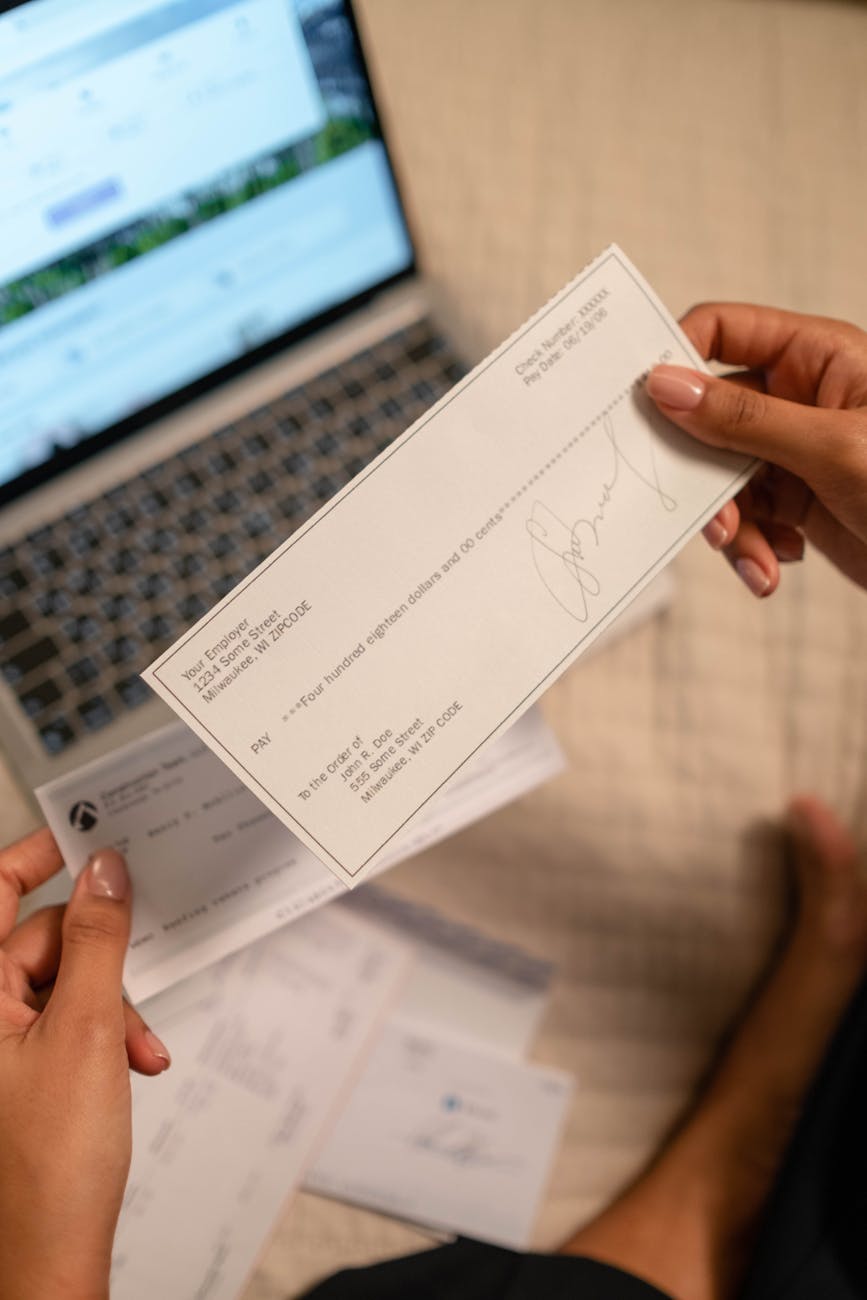

A checking account is like your everyday money spot. It’s what you use for daily stuff like buying snacks, paying for things online, or getting cash from an ATM. It’s easy to put money in and take money out whenever you want. You might have a debit card linked to it, so you can swipe or use it online. Think of it like your wallet, but on the computer or bank app.

Savings Account

A savings account is for money you want to keep safe and maybe grow a little over time. It’s where you save up for something big, like a new phone or a trip. You can’t use it as often because it’s meant to help you set money aside. Usually, you can’t spend from it as easily—you might need to transfer money to your checking account first. It’s like a piggy bank, but in the bank, and usually earns a tiny bit of interest (extra money) for keeping your savings there.

The Main Difference

- Checking Account: Use it for everyday spending. Easy to access and spend money.

- Savings Account: Use it to save for the future. It’s safer for your money and helps it grow.

Why Both Are Good

Having both lets you manage your money better. Use your checking account for daily needs, and put extra money into your savings account so you don’t spend it all and can reach your goals faster.

Quick Tip: Always keep track of what’s in each account so you don’t overspend and have enough saved for what you really want.

That’s the simple scoop on checking vs. savings accounts. They work together to help you stay organized and reach your money goals!

Leave a comment